Renters Insurance in and around Bend

Renters of Bend, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

Think about all the stuff you own, from your entertainment center to laptop to books to kitchen utensils. It adds up! These possessions could need protection too. For renters insurance with State Farm, you've come to the right place.

Renters of Bend, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Agent James Chrisman, At Your Service

Renting a home is the right decision for a lot of people, and so is protecting your belongings with insurance. In general, your landlord's insurance might cover damage to the structure of your rented home, but that doesn't cover the repair or replacement of your belongings. Renters insurance helps safeguard your personal possessions in case of the unexpected.

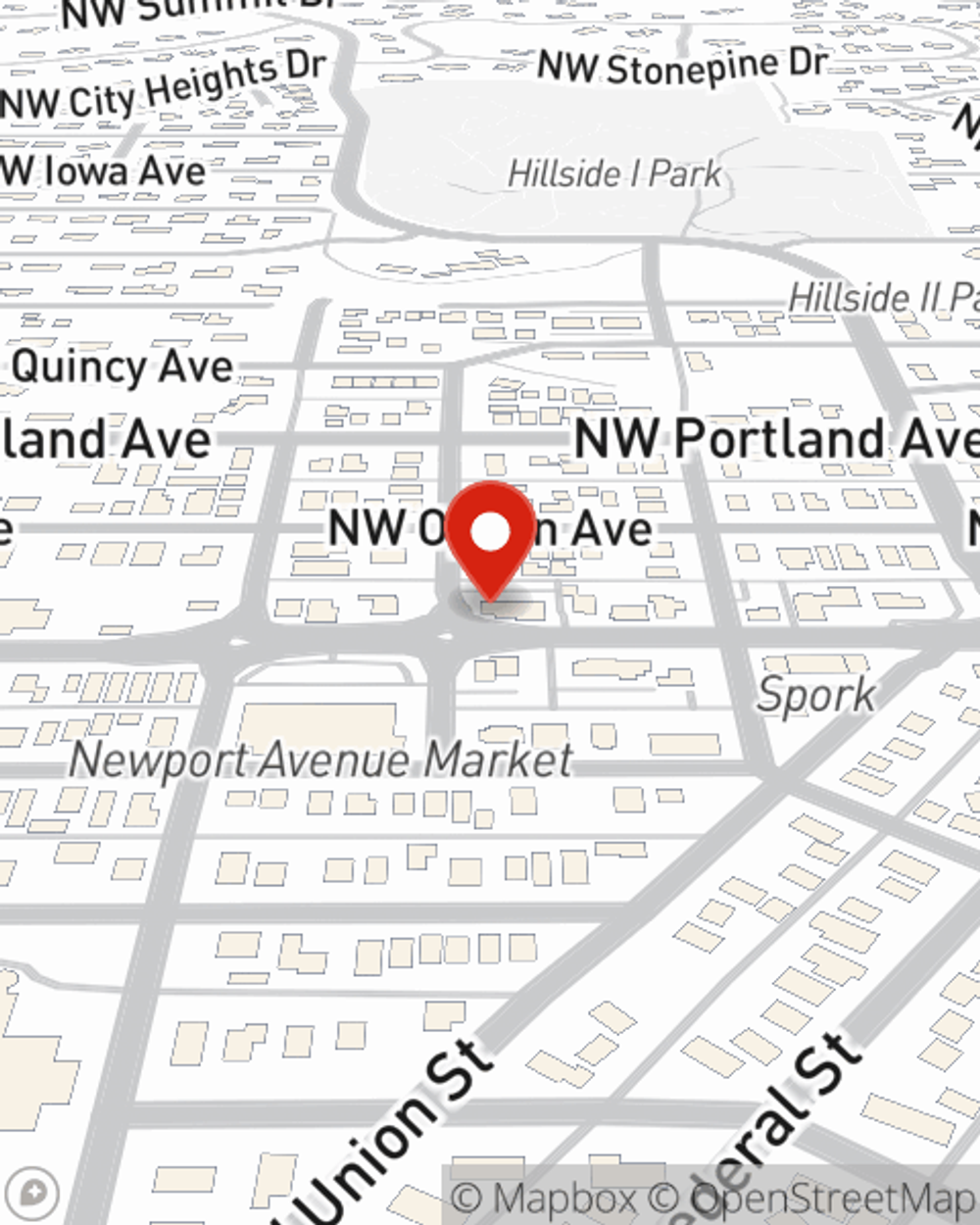

There's no better time than the present! Visit James Chrisman's office today to discuss your coverage options.

Have More Questions About Renters Insurance?

Call James at (541) 388-9204 or visit our FAQ page.

Simple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.

James Chrisman

State Farm® Insurance AgentSimple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.